Meiro RFM Model, Analysis & Segmentation Explained

|

Learn about: |

What is RFM?

RFM (Recency, Frequency, Monetary) is a proven marketing strategy used by marketers for analyzing and estimating the value of a customer, based on Recency, Frequency and Monetary Value (Total Spend) in order to reasonably predict their customer lifetime value and which customers are more likely to make purchases again in the future.

Recency: How recently a customer has made a purchase.

Frequency: How often a customer makes a purchase.

Monetary Value: Total amount a customer has spent on purchases.

Why is RFM useful?

RFM helps companies to know their loyal customers, implement actions on at-risk customers and move them up the funnel to avoid losing customers, and to boost sales by improving their marketing techniques and target the campaigns more accurately to those customers’ desires and needs.

In summary, it helps in:

- Personalisation of campaign message

- Increase conversion rates

- Increase revenue and profits

- Retain customers

Input Data

On Meiro CDP, we ease the RFM calculation and analysis for our clients and they only need to define and build selected segments (e.g. deciles, segment names and classification) for their marketing campaigns to target.

- We obtained eCommerce data containing “days since last transaction”, “number of transactions made per day” and “total transactions amount” for each customer from our clients’ databases.

- Data is checked for quality, queried and processed with SQL.

Data is checked for quality for its completeness, accuracy, consistency, validity, timeliness and integrity. Outliers can be removed by adjusting the outlier percentage and only take 98-99% of the entire dataset. Also, it is recommended to have a data volume of 10k customers with 100k transactions over a period of more than 1 year to get an accurate analysis.

The RFM Model will not be able to run properly if there is:

- Inaccurate identification of customers

- Data quality issues e.g. insufficient and incomplete data

- Skewed data

How do we do it?

eCommerce stores have different sales cycles. Depending on what is being sold and the unpredictability of the market, a customer with 10 orders placed may receive a different score depending on the sales cycle.

We will first need to define different customer segments through RFM modelling based on buying patterns in relation to all the other customers.

Each customer will be assigned points for Recency, Frequency, and Monetary and segmented according to the defined RFM model.

Below is an example of how a standard RFM model on customer segmentation looks like, the score for recency, frequency and monetary for each customer segment can be adjusted but the basic customer segments presented below should remain as much as possible. Additional customer segments can be added based on the client's needs.

|

Customer Segment |

Activity |

Recency |

Frequency |

|

|

Champion |

Bought recently and often, spent the most |

>=90 |

>=90 |

>=90 |

|

Loyal |

Loyal to the brand, consistent |

40-80 |

>=70 |

>=70 |

|

Potential Loyalist |

Bought recently, spent a good amount and bought more than once |

>=90 |

40-60 |

40-80 |

|

Newbies |

Recent first purchase and did not spend a lot |

>=90 |

N/A |

<=30 |

|

Fading |

Have not purchased recently, spent a good amount and bought more than |

40-60 |

40-80 |

40-80 |

|

At Risk |

Have not purchased for quite some time, spends a good amount and bought often |

<=30 |

>=90 |

>=90 |

|

Lost |

Have not purchased for quite some time, did not purchase often and low purchase amount |

<=30 |

<=30 |

<=30 |

After defining the customer segments, we will need to look into categorising RFM values from the eCommerce purchase history.

The RFM score of each customer segment seen above is tabulated below and determined based on all customers’ order transaction data. Take note that the numbers below serve as a guide and it can change according to the client’s dataset.

|

Percentile |

Recency |

Frequency |

Lifetime Monetary |

|

10th |

109 - 119 |

0 - 3 |

0 - 279.05 |

|

20th |

104 - 108 |

4 - 5 |

279.06 - 500 |

|

30th |

100 - 103 |

6 |

501 - 769.76 |

|

40th |

96 - 99 |

7 - 8 |

769.77 - 1042.97 |

|

50th |

93 - 95 |

9 |

1042.98 - 1389.16 |

|

60th |

91 - 92 |

10 - 11 |

1389.17 - 1768.6 |

|

70th |

89 - 90 |

12 - 13 |

1768.7 - 2244.8 |

|

80th |

87 - 88 |

14 - 16 |

2244.9 - 3011.72 |

|

90th |

85 - 86 |

17 - 20 |

3011.79 - 4101.23 |

|

100th |

0 - 84 |

21 - 53 |

4101.24 - 21253.73 |

For example, if a customer spends $4,500 in total lifetime transaction value and has made 18 purchases previously, his/her RFM score will be recency: 100, frequency: 90, monetary: 100 and his/her status will be “Champion”.

Output Data

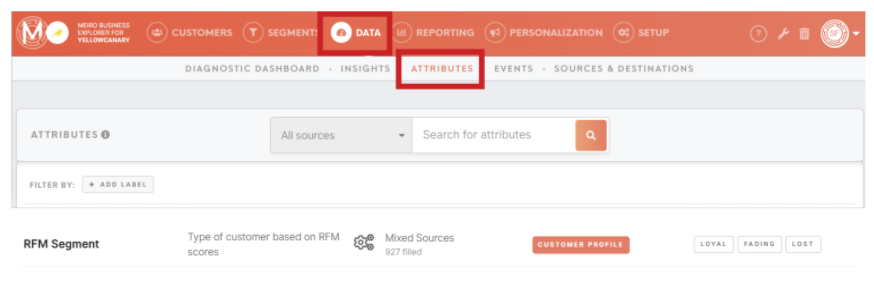

On the Meiro Business Explorer interface, navigate to Data > Attributes > RFM Segment, you will find the RFM attribute that is tailored to your business needs.

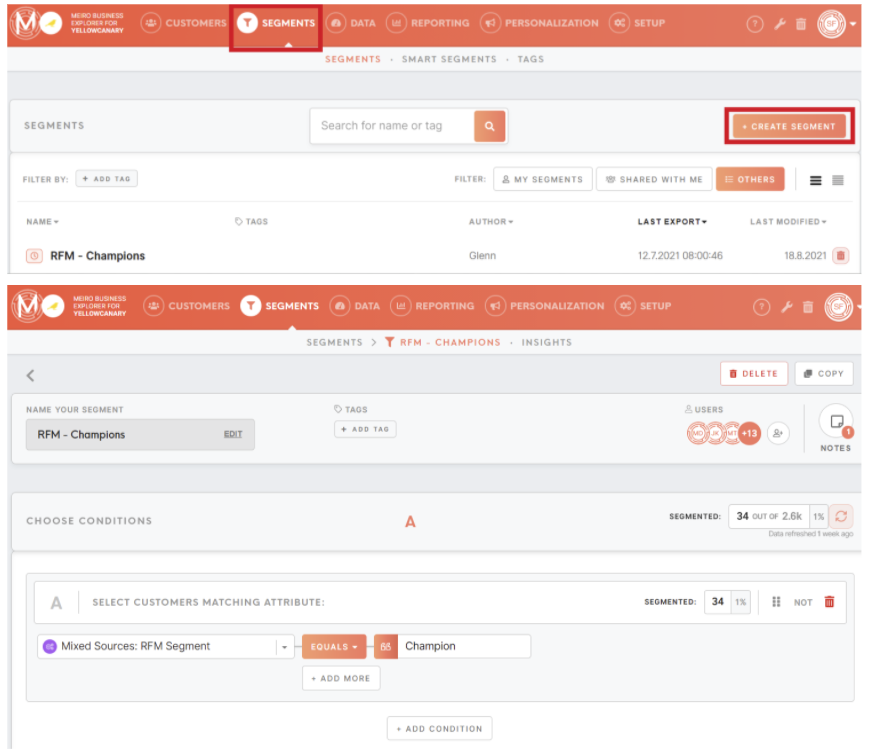

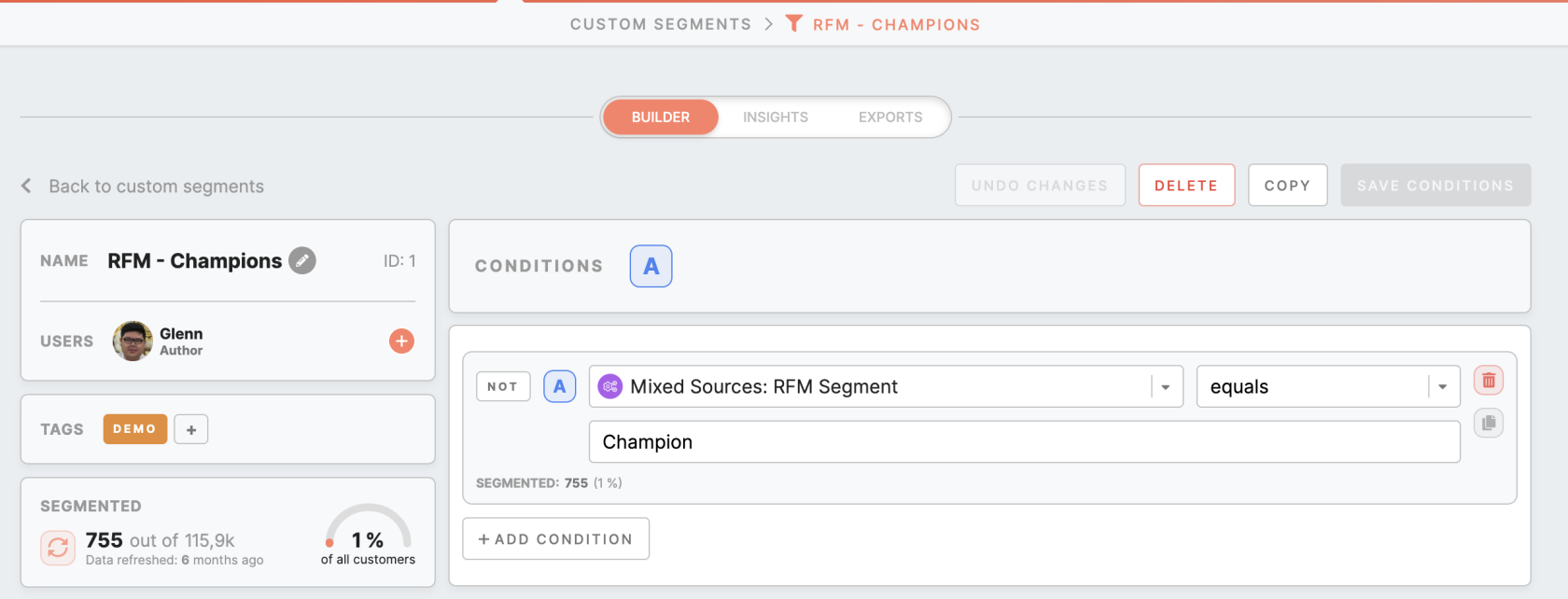

You can create customer segments suitable for each campaign, navigate to Segment > Create Segment, select “Mixed Sources: RFM Segment” and define the customer segment based on the RFM model created previously. Export the customer segment out to your destination (e.g. Google Ads) for activation.

Learn more: https://www.putler.com/rfm-analysis/

Learn more: https://www.investopedia.com/terms/r/rfm-recency-frequency-monetary-value.asp

Learn more: https://www.ibm.com/docs/en/spss-statistics/23.0.0?topic=option-rfm-analysis